How Access to Microfinance Is Changing Lives in Malawi

Access to financial services has long been a challenge for many Malawians, especially in rural and underserved communities. Traditional banks often require high collateral, formal employment, or large transaction volumes—leaving many out of the system

But today, microfinance is breaking down those barriers—one loan, one business, one life at a time. It’s not just about getting money into people’s hands; it’s about opening doors to economic participation and resilience

At Fastkwacha, we see microfinance not just as small loans, but as big opportunities. Whether it’s a farmer needing fertilizer before the rains, a market vendor looking to double her stock, or a youth launching a barber shop or tech side hustle, our loans give people the capital and confidence to grow.

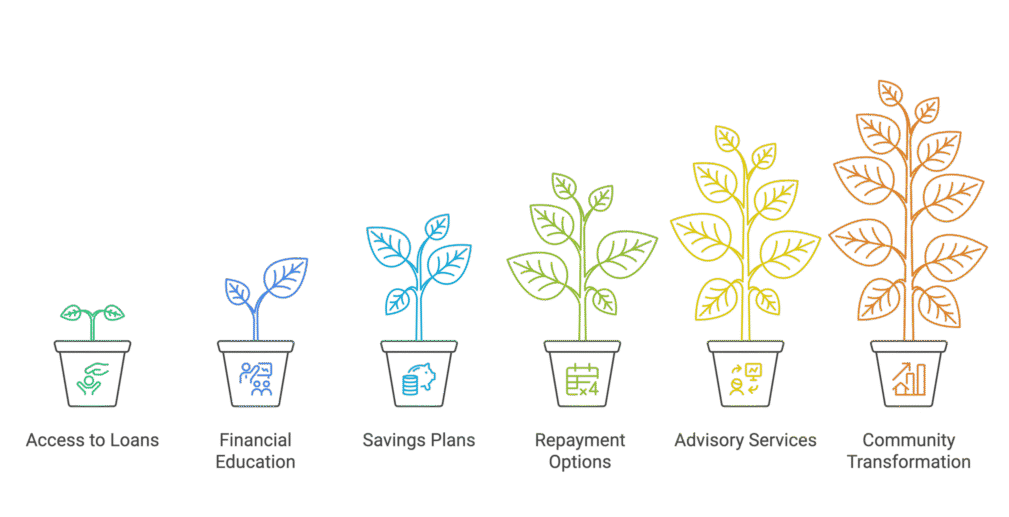

We don’t stop at lending. Our microfinance model is built on flexibility, financial education, and support. We offer savings plans, accessible repayment options, and advisory services—because we know that sustainable change comes when people are equipped to manage and multiply their income.

The results? Families sending their children to school. Entrepreneurs creating jobs in their communities. Women gaining independence. It’s more than finance—it’s transformation.

💡 Success Tip: Start small but think big. Even a modest loan, when paired with the right mindset and tools, can become the foundation of a thriving future.